Week ending 31st October

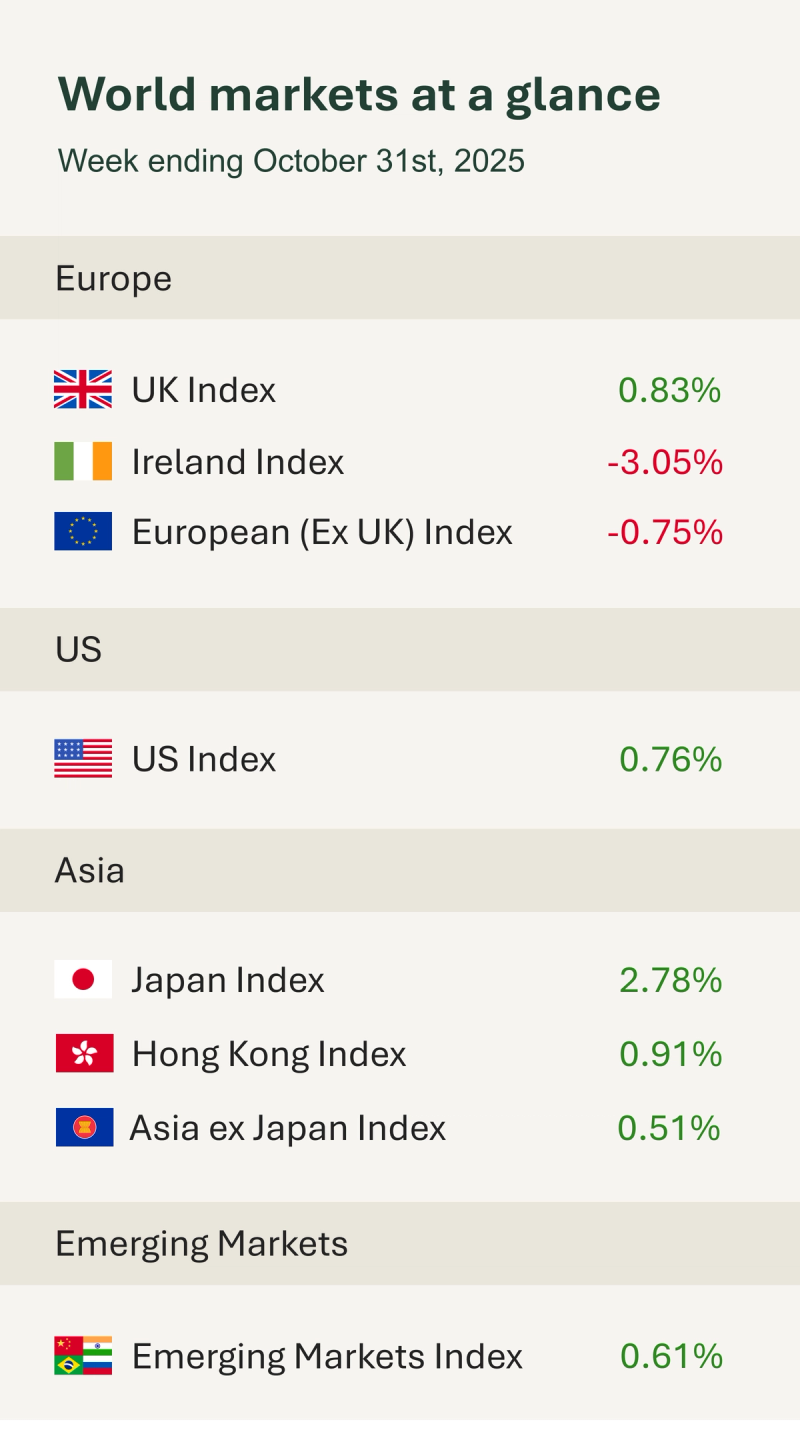

As shown in the accompanying table, global financial markets had a broadly positive week, driven by developments in geopolitics, trade negotiations, and corporate earnings.

President Donald Trump had a packed week touring Asia, engaging in a series of trade and diplomatic efforts. In Malaysia, he agreed to new trade deals while Southeast Asian leaders gathered for a peace agreement between Thailand and Cambodia.

In Japan, Trump met newly elected Prime Minister Sanae Takaichi. The two signed agreements to secure rare earth supply chains and reaffirm earlier trade commitments, with one deal dubbed the “New Golden Age.”

His final stop was South Korea, where he agreed to lower U.S. auto tariffs to 15% as part of a broader trade package. He also met with Chinese President Xi Jinping for a pivotal discussion on U.S.–China relations. The two sides had already outlined a framework ahead of the meeting, which lasted one hour and forty minutes. A threatened 100% tariff on Chinese goods was avoided, and existing tariffs were reduced by 10%, bringing them down to 47%. China agreed to resume purchases of American soybeans and will be allowed to buy advanced U.S. computer chips, though Nvidia’s Blackwell chip remains restricted. Restrictions on China’s exports of rare earth minerals, vital for smartphones and cars, were also eased. The U.S. had previously responded to the flow of chemical ingredients used in fentanyl production with tariff adjustments.

The deal is expected to last for one year, with reciprocal tariffs suspended during that time. While not yet signed, it is being viewed as a breakthrough in easing trade tensions. President Trump is expected to visit China in April to finalise the agreement.

Despite some progress on trade, investor focus remained firmly on the Federal Reserve’s latest policy decision. As expected, the Fed cut rates by 25 basis points to a range of 3.75%–4.00%. While markets initially welcomed the news, sentiment shifted during Chair Powell’s press conference, where his tone was more hawkish than anticipated. Powell highlighted divisions within the committee and stressed that a December rate cut is “not a foregone conclusion,” reaffirming the Fed’s data-driven approach. He also raised concerns about limited data availability due to the government shutdown, which could lead to greater caution if key labour and inflation reports are delayed. The press conference led markets to scale back expectations for a December cut. For now, the Fed sees little sign of significant labour market weakness, supporting a patient stance on easing.

This week was the busiest of the Q3 earnings season, with 64% of S&P 500 companies having reported by Friday morning—83% of them beating consensus estimates. Five of the “Magnificent Seven” (Microsoft, Alphabet, Meta, Apple, and Amazon), which together represent about a quarter of the index, released results that heavily influenced market sentiment. Alphabet posted strong cloud growth, Amazon offered upbeat guidance, and Apple met expectations. Meta missed earnings per share due to a one-off tax charge, while Microsoft beat across the board but saw shares dip on spending concerns. Overall, earnings were solid, reflecting resilient corporate fundamentals despite macroeconomic uncertainty.

European markets ended the week lower as hopes for further ECB rate cuts faded following Thursday’s meeting. As expected, the ECB held its deposit rate at 2% for the third time, reflecting confidence that inflation has eased from post-pandemic and energy crisis highs. President Christine Lagarde noted the eurozone’s continued resilience despite global challenges and reiterated that future rate decisions will remain data-dependent, with no changes likely before next year.

Coming up next week, earnings season continues, European retail sales, and the Bank of England’s interest rate decision on Thursday 6th November where policymakers are expected to hold rates steady at 4.00%.

Kate Mimnagh, Portfolio Economist