Weekly Market Summaries

Week ending 30th May 2025.

2nd June 2025

Week ending 30th May 2025.

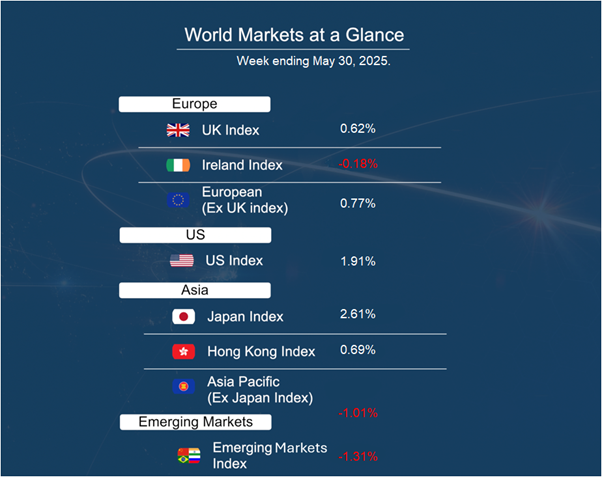

As you can see from the accompanying table global equity closed out May on a broadly positive footing, with strong gains in the U.S. and Asia helping offset softer performances in parts of Europe and emerging markets. Equities were supported by encouraging inflation data and evolving trade policy developments. Despite a shortened trading schedule due to Memorial Day in the U.S. and the Spring Bank Holiday in the U.K., risk appetite remained intact, allowing investors to extend gains from an already strong May.

In the U.S., all major indices advanced over the week, capping a solid month for equities. The S&P 500 delivered a total return of over 5% in GBP terms in May—a marked recovery from April’s softer performance.

Sentiment received an early lift from news that President Trump would delay implementation of a proposed 50% tariff on EU imports until 9 July, providing a window for renewed negotiations. Markets reacted positively again midweek when the U.S. Court of International Trade struck down most of the Trump-era global tariffs. While equities initially rallied, gains were trimmed after an appeals court temporarily paused the ruling, pending further review.

Although trade headlines continued to inject volatility, markets digested developments with relative composure. A modest pullback on Friday followed renewed tensions between the U.S. and China, with both sides exchanging accusations. In such an environment, policy shifts can occur rapidly. While near-term volatility is to be expected, our investment teams remain focused on fundamentals and are prepared to act on opportunities arising from short-term dislocations in sentiment.

Though the broader narrative was one of cautious optimism—underpinned by more favourable data and a degree of flexibility in policy discussions.

Economic indicators broadly supported this constructive tone. The U.S. Core PCE inflation rate—the Federal Reserve’s preferred measure—slowed to 2.5% year-on-year in April, its lowest reading since 2021. While still above the Fed’s 2% target, the downward trajectory suggests inflationary pressures may be gradually easing.

The US Labour market data also pointed to a modest cooling, with initial jobless claims rising to 240,000—the highest level in a month—and continuing claims edging higher. Taken together, these trends could support the case for a more dovish stance from the Fed over the coming quarters.

Meanwhile, U.S. consumer sentiment showed signs of stabilisation. The University of Michigan’s final May reading held steady at 52.2, ending a four-month streak of declines. Sentiment improved particularly in the latter half of the month, aligning with a temporary pause in U.S.-China trade tensions—a timely reminder of the market’s sensitivity to geopolitical developments.

In the U.K. and across Europe, equities also moved higher, largely mirroring the relief rally seen in U.S. markets. The delay in tariff implementation was welcomed by investors as a potential step towards more constructive trade dialogue.

Looking ahead, attention will turn to eurozone inflation data and the upcoming European Central Bank meeting for further insight into the region’s monetary policy trajectory. While trade policy remains a key driver of short-term market direction, the combination of easing inflationary pressure and resilient equity markets provides a constructive backdrop as we head into the summer months.

Kate Mimnagh, Portfolio Economist